How key tax relief rates mean a €45,000 jeep can have same net after-tax cost for farmers as a car costing €32,000 - Farming Independent

raghav paid 10% of his salaru as income tax. if he has Rs32000 after paying income tax , then find his - Brainly.in

Renta 2022: qué es la casilla 505 y cómo obtener el número de referencia para hacer la Declaración | Marca

![OC] After-tax income for men and women from the Toronto census metropolitan area : r/dataisbeautiful OC] After-tax income for men and women from the Toronto census metropolitan area : r/dataisbeautiful](https://preview.redd.it/after-tax-income-for-men-and-women-from-the-toronto-census-v0-ebvl4c0guue81.png?auto=webp&s=c7dcaa5d317a2249795743eb8e65c01871284d5e)

OC] After-tax income for men and women from the Toronto census metropolitan area : r/dataisbeautiful

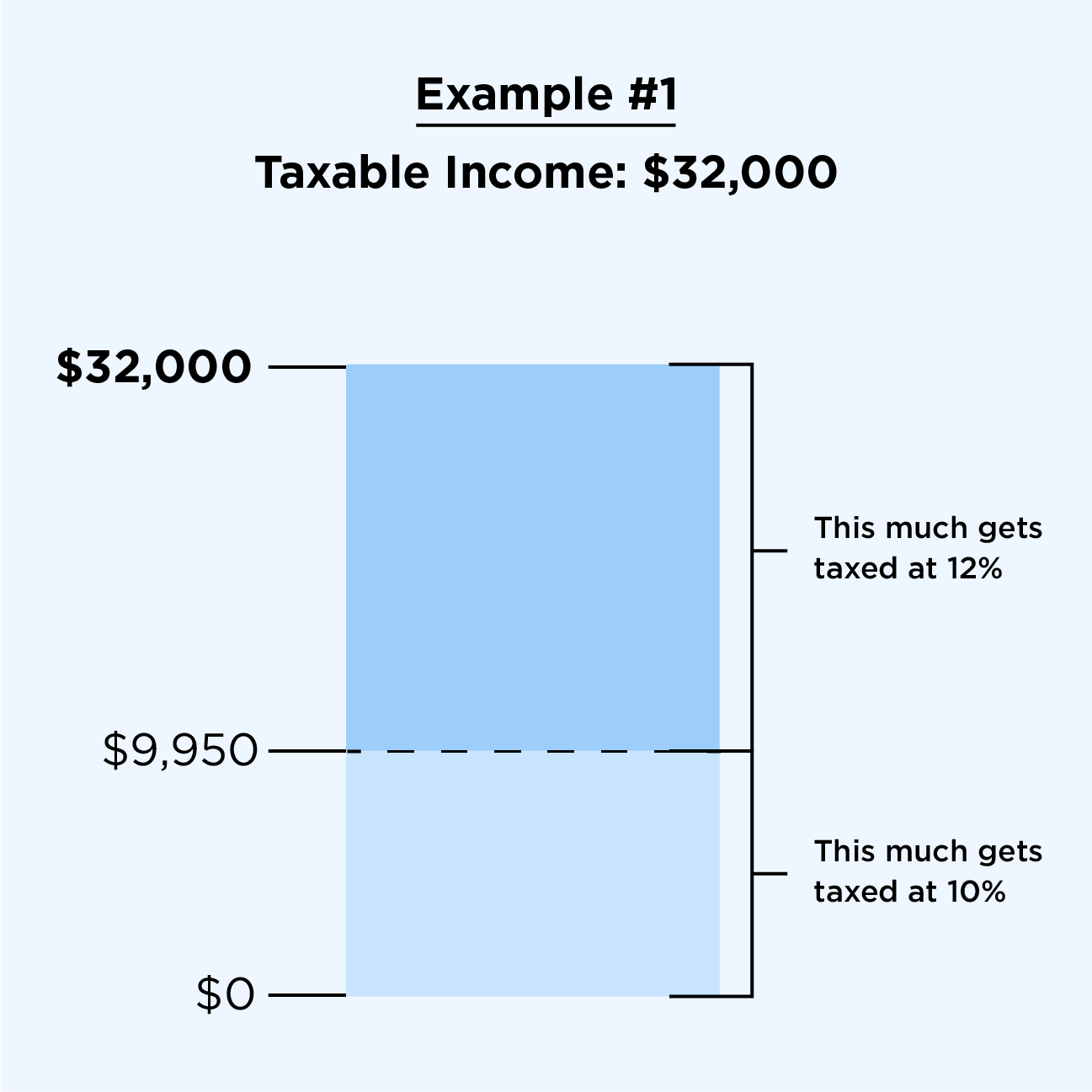

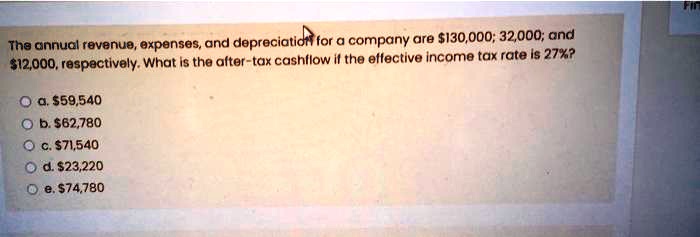

SOLVED: The annual revenue,expenses,and depreciatid for a company are 130.000;32,000;and12,000,respactively.What is the after-tax cashflow if the effective income tax rate is 27% Oa.$59,540 Ob.$62,780 c.$71,540 Od.$23,220 .$74.780