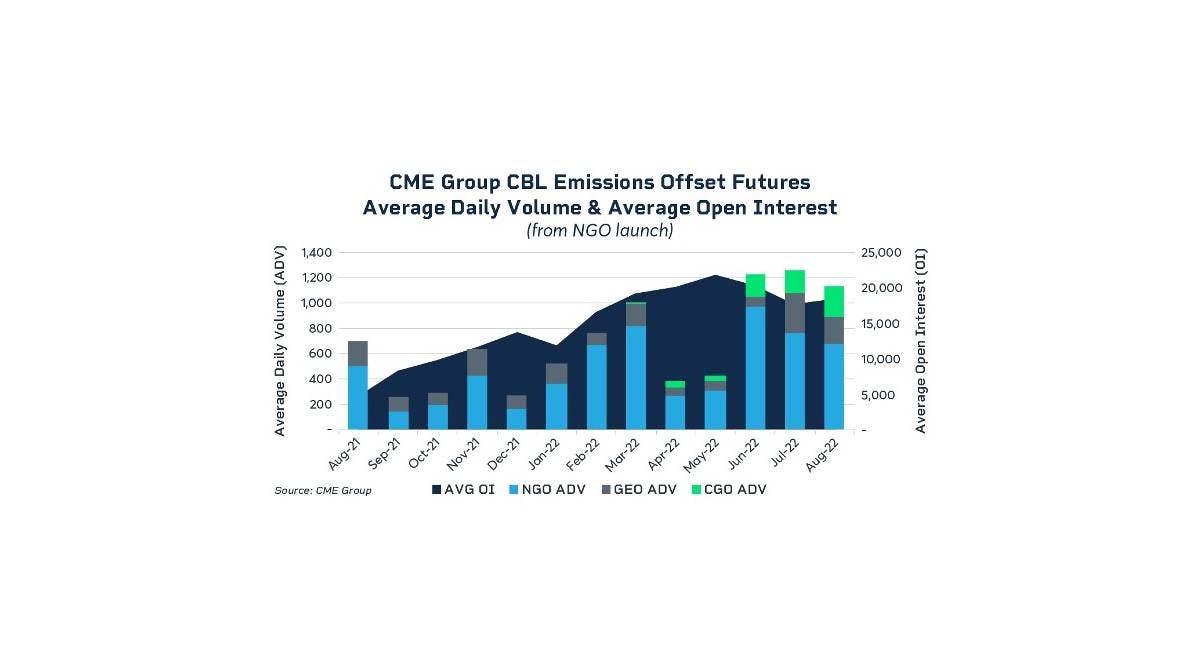

Exchange in Focus: CME Group's Voluntary Carbon Emissions Offset Contracts Surpass 100 Million Offsets Traded | Sustainable Stock Exchanges

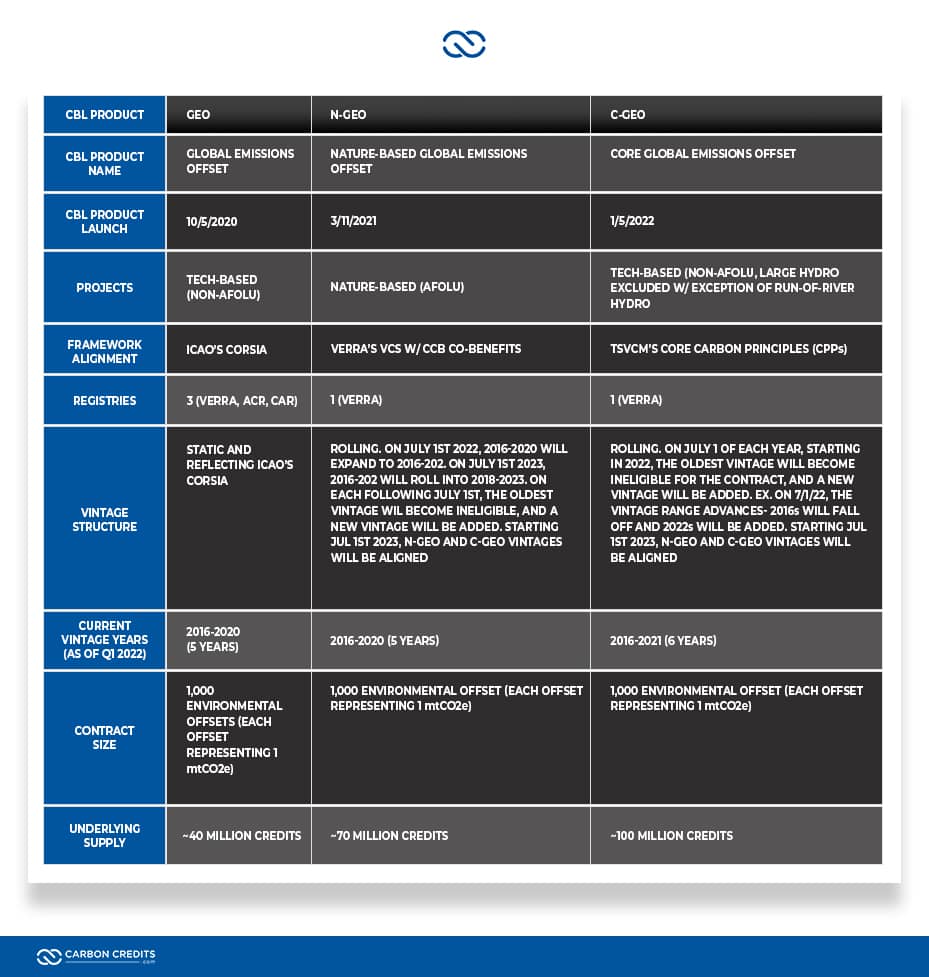

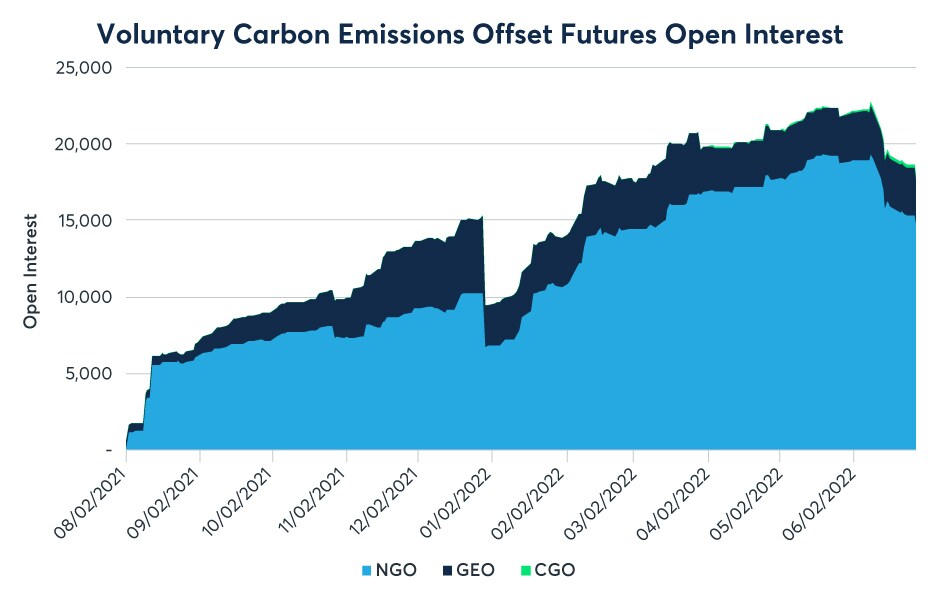

CME Group on Twitter: "Carbon Pulse discusses the launch of U.S.-based asset manager KraneShares' Global Carbon Offset Strategy ETF on April 27, which will track CBL GEO and CBL N-GEO futures contracts.

CME Group starts up nature-based offsets to meet growing demand | 2021-06-21 | Agri-Pulse Communications, Inc.

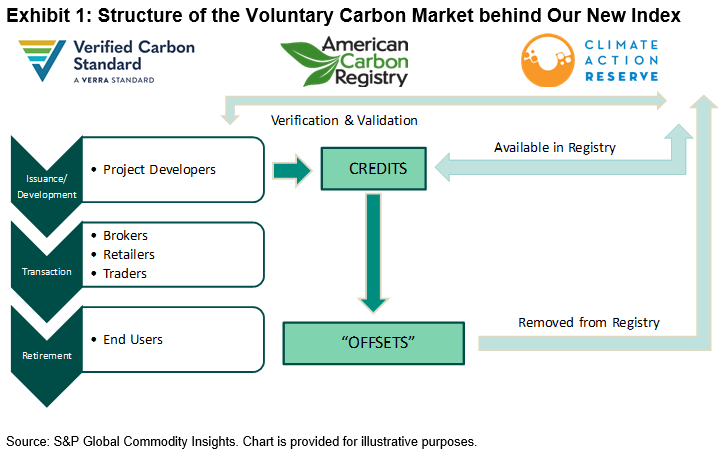

Introducing the First Global Voluntary Carbon Market Index – Indexology® Blog | S&P Dow Jones Indices