Initial public offerings, bonus and rights issues will be eligible for concessional rate of 10% long-term capital gains (LTCG) tax even if the Securities Transaction Tax (STT) has not been paid earlier.

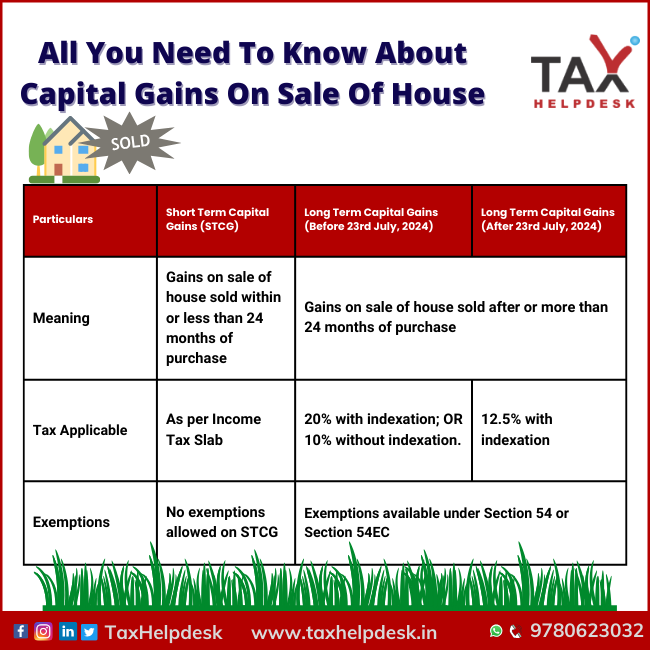

Short-Term vs Long-Term Capital Gains Below infographics details, the top 5 differences between the short-term vs long-te… | Capital gain, Capital gains tax, Gain

.png)

:max_bytes(150000):strip_icc()/capital_gains_tax.asp-Final-2add8822d04c4ea694805059d2a76b19.png)