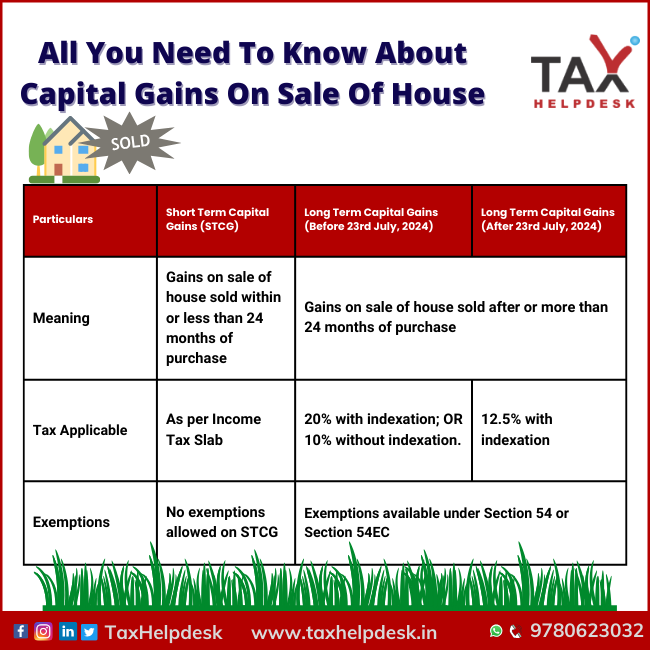

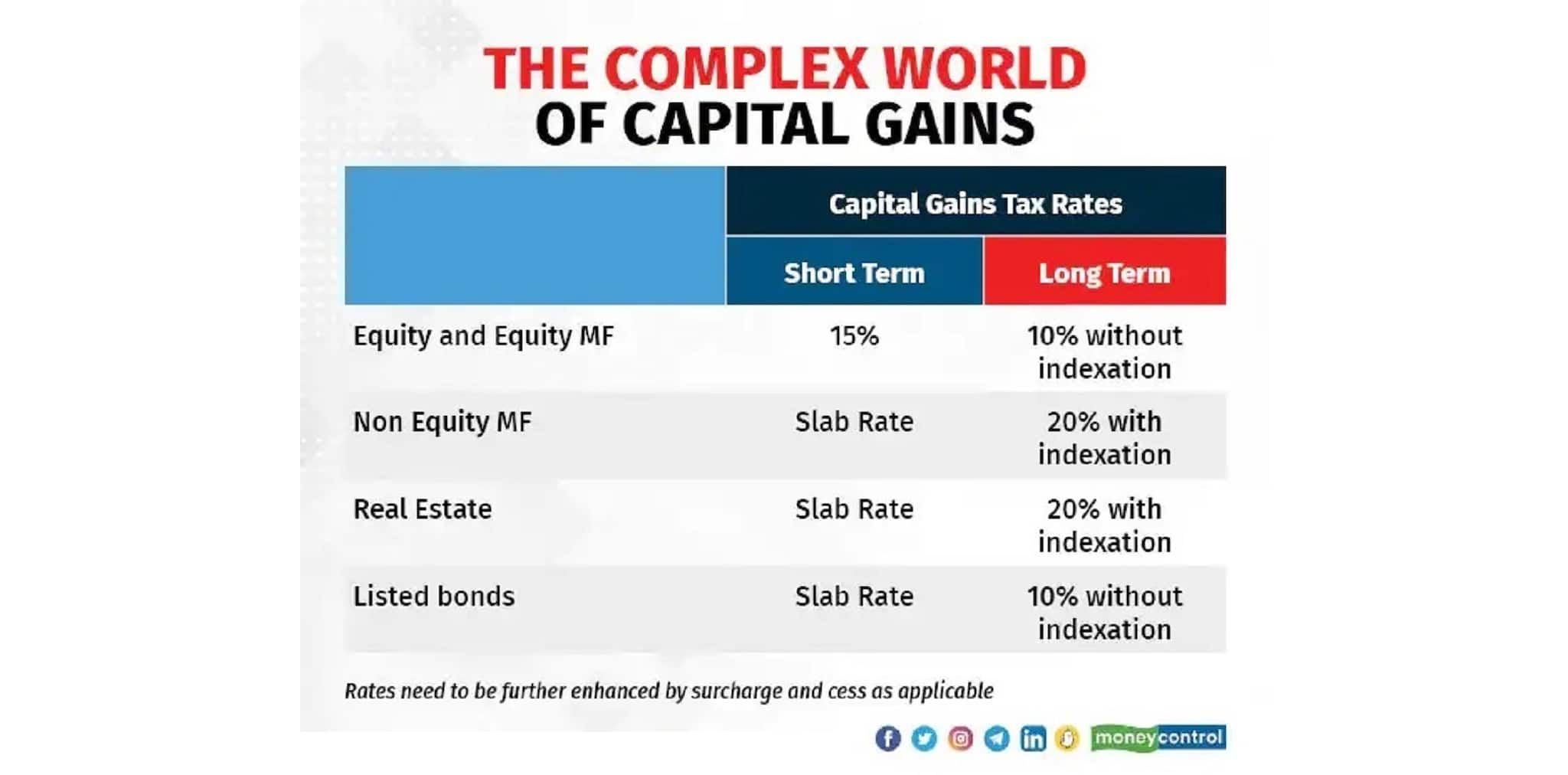

Rationalisation of holding period requirement Most investors find it hard to get a clear idea of threshold limits for deciding if an asset is classified as long-term or short-term to decide the

capital gain: How to calculate short-term and long-term capital gains and tax on these - The Economic Times

Difference Between Short and Long Term Capital Gains - Compare & Apply Loans & Credit Cards in India- Paisabazaar.com

:max_bytes(150000):strip_icc()/capital_gains_tax.asp-Final-2add8822d04c4ea694805059d2a76b19.png)