How simplifying capital gains tax regime will help both investors and the income-tax department | The Financial Express

Short Term vs Long Term Capital Gains|Difference between short term and long term capital gain - YouTube

![5.1 General Tax Rules for Property Sales - J.K. Lasser's Your Income Tax 2013: For Preparing Your 2012 Tax Return [Book] 5.1 General Tax Rules for Property Sales - J.K. Lasser's Your Income Tax 2013: For Preparing Your 2012 Tax Return [Book]](https://www.oreilly.com/api/v2/epubs/9781118562338/files/images/f100-01.jpg)

5.1 General Tax Rules for Property Sales - J.K. Lasser's Your Income Tax 2013: For Preparing Your 2012 Tax Return [Book]

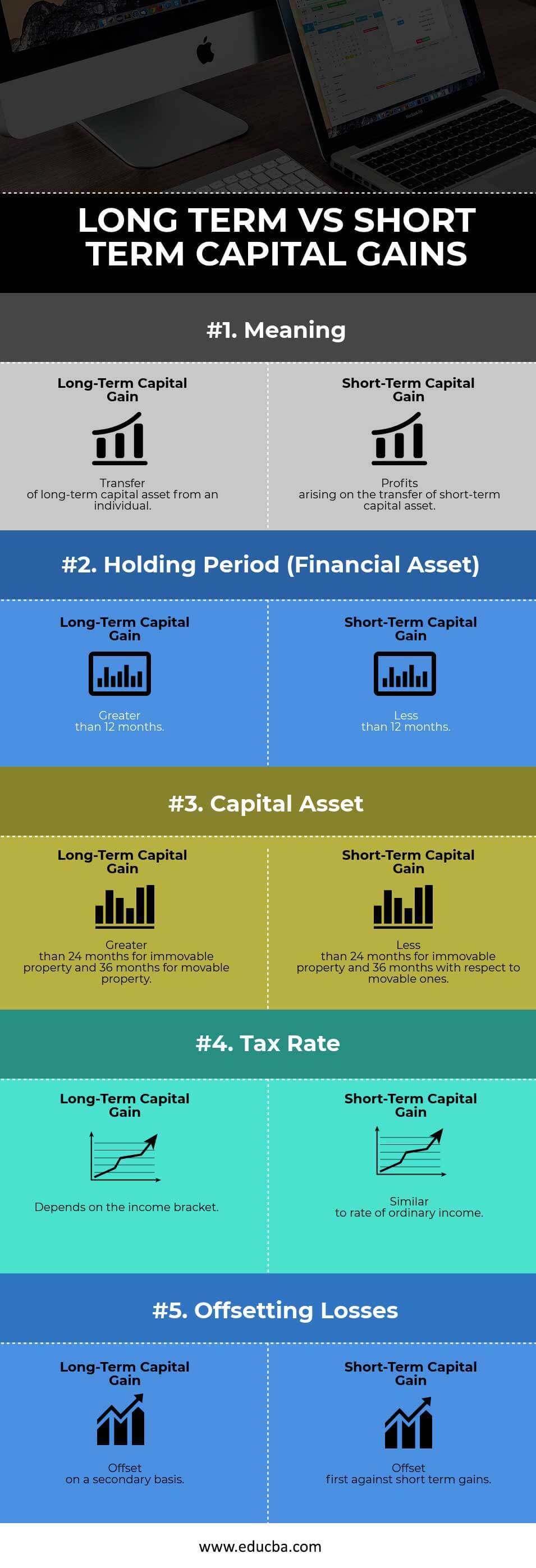

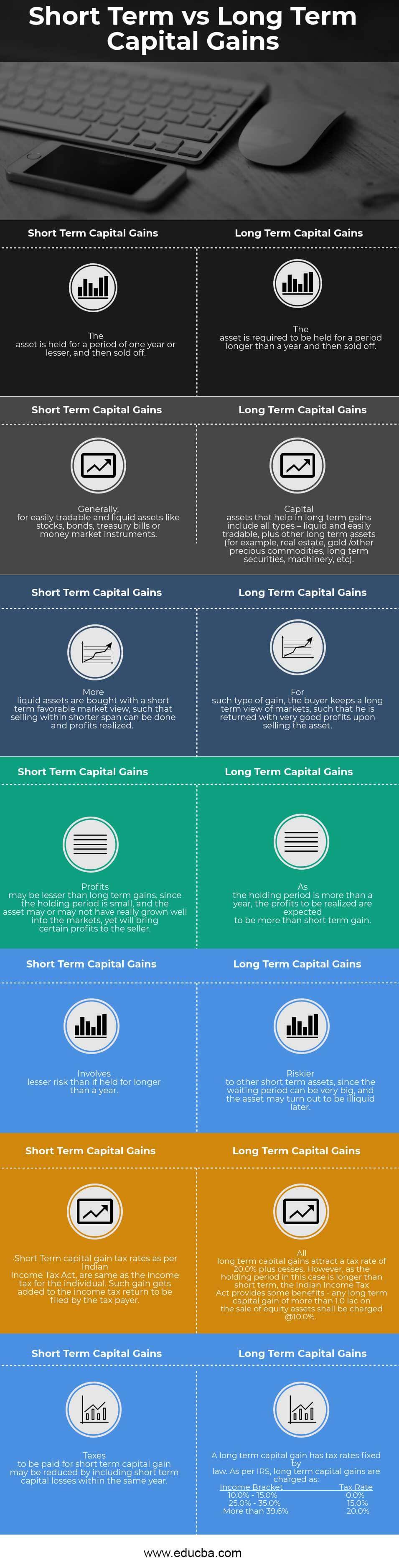

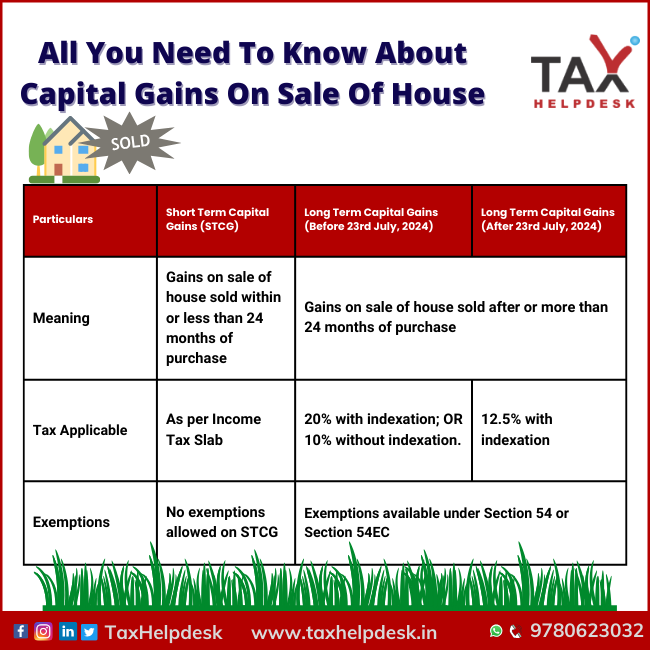

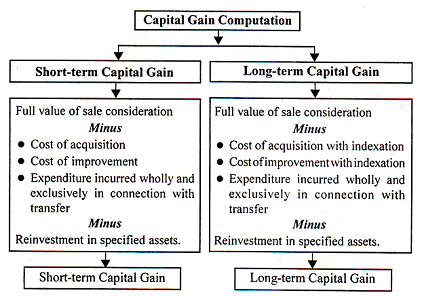

Difference Between Short and Long Term Capital Gains - Compare & Apply Loans & Credit Cards in India- Paisabazaar.com