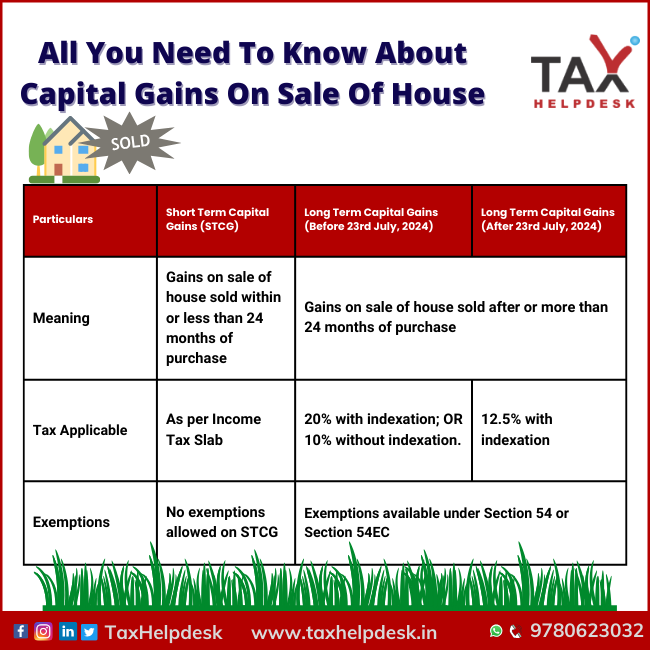

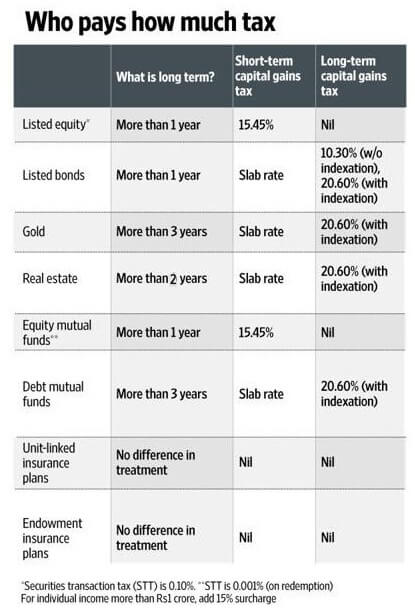

Initial public offerings, bonus and rights issues will be eligible for concessional rate of 10% long-term capital gains (LTCG) tax even if the Securities Transaction Tax (STT) has not been paid earlier.

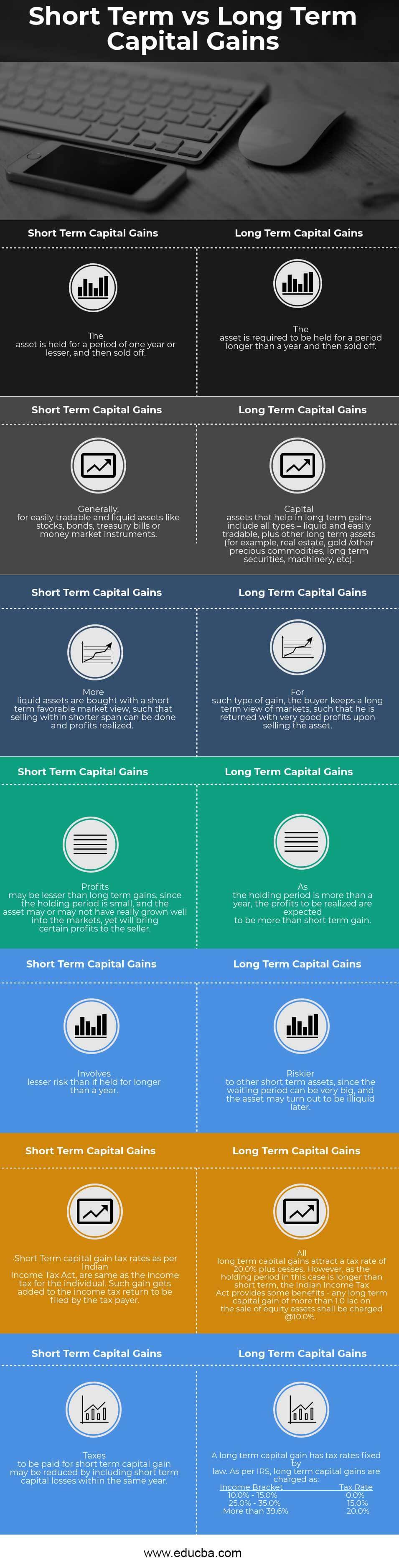

Difference Between Short and Long Term Capital Gains - Compare & Apply Loans & Credit Cards in India- Paisabazaar.com

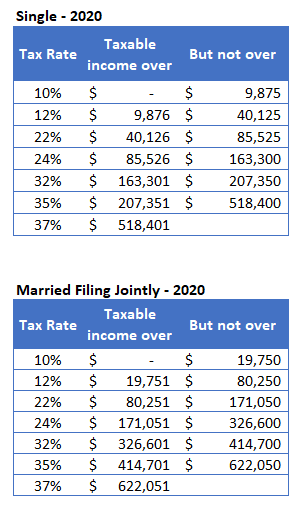

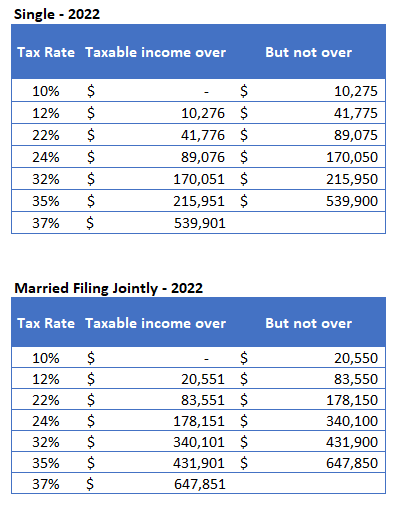

Update from an earlier post. Here is the most up to date tax bracket for Short and Long term capital gains taxes. Based on 2022. : r/amcstock

:max_bytes(150000):strip_icc()/Capital-gain-2e9b43786c824dba8394bf73bd77f81e.jpg)