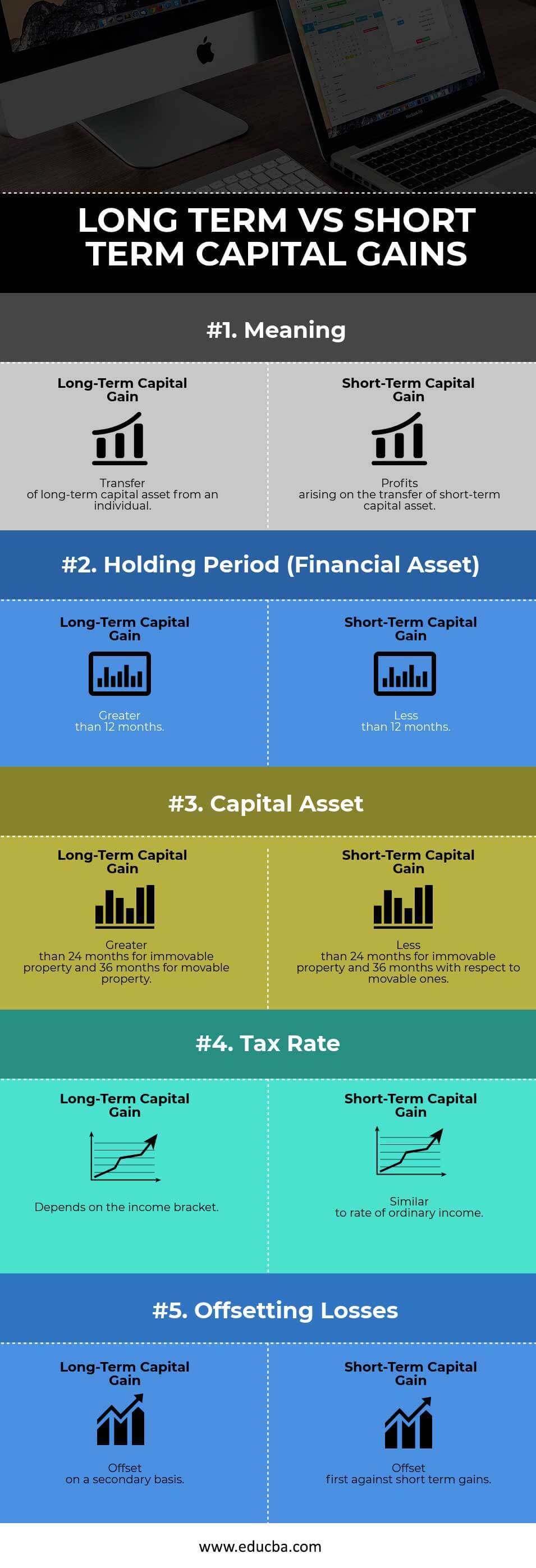

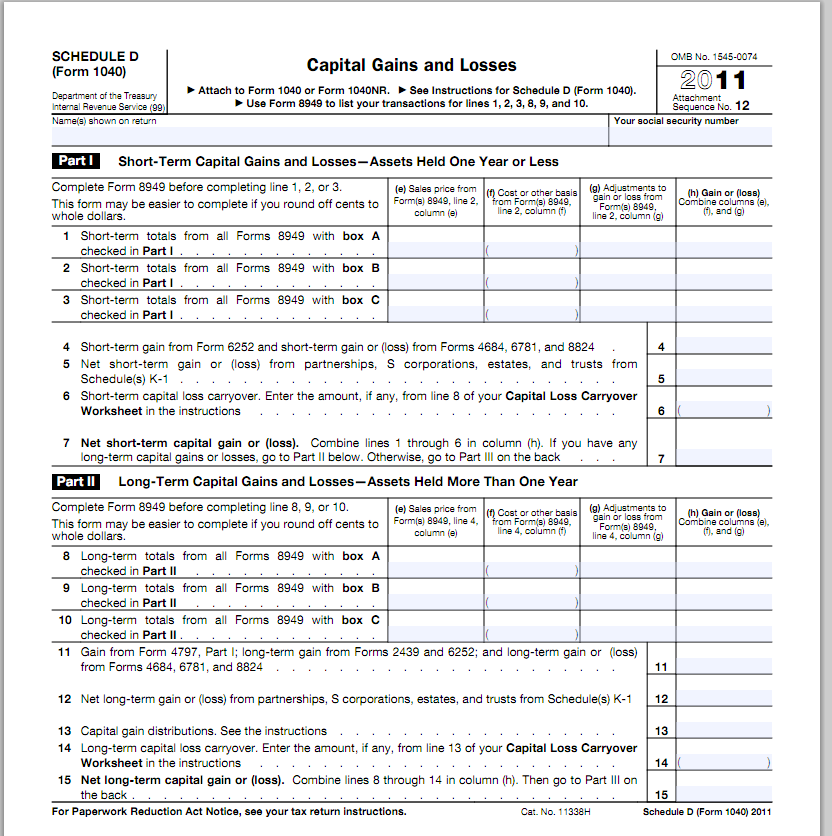

Income Tax Department, India - UNDERSTANDING CARRY FORWARD AND SET OFF OF LOSSES Income comes under five heads - salary, income from house property, income from business and profession, capital gain and

Can short-term losses from stocks be adjusted against long term gains? - All you need to know about LTCG on equity investments | The Economic Times