capital gain: How to calculate short-term and long-term capital gains and tax on these - The Economic Times

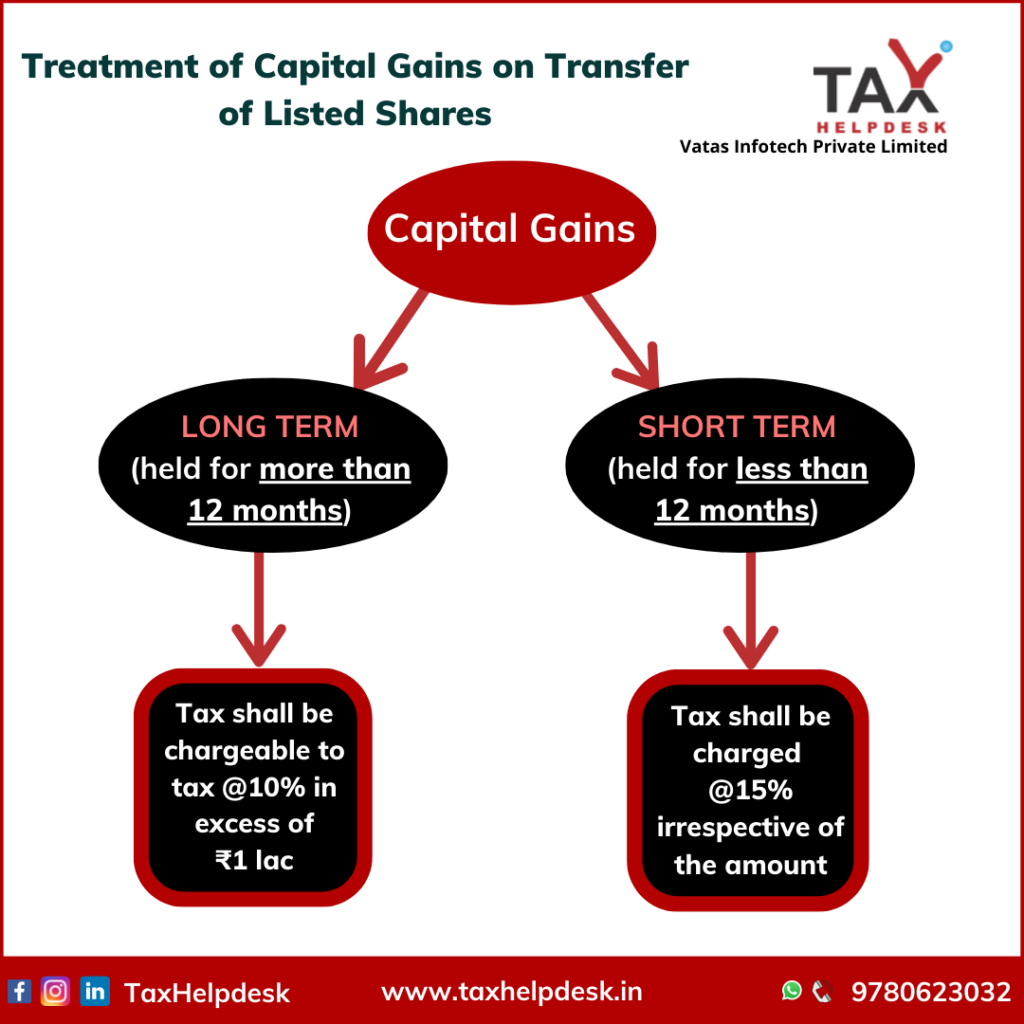

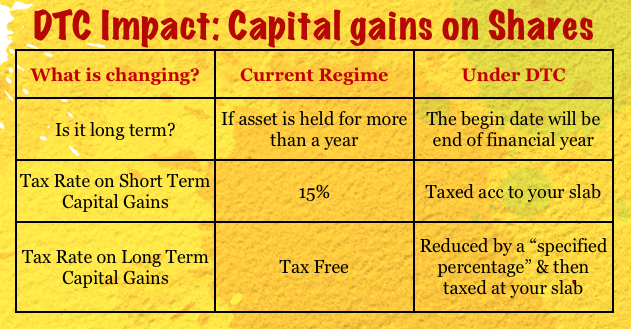

Capital Gain Tax News Today: Long and Short-Term Capital Assets and How Gains From Shares are Taxed | The Financial Express

Income Tax on EQUITY | How is Tax Calculated on SHORT TERM CAPITAL GAINS and LONG TERM CAPITAL GAINS - YouTube

:max_bytes(150000):strip_icc()/capital_gains_tax.asp-Final-2add8822d04c4ea694805059d2a76b19.png)

![Taxation on Short Term Capital Gains | Income Tax on STCG @15% [Examples] - YouTube Taxation on Short Term Capital Gains | Income Tax on STCG @15% [Examples] - YouTube](https://i.ytimg.com/vi/b3Ni2ZJzpkE/maxresdefault.jpg)